ESG

Sustainable capital investments in real assets – challenges and solutions for sustainable investment funds

Houses and buildings are shaping the urban landscape and the socio-cultural environment of cities and neighbourhoods for decades. We spend 90% of our time in homes, offices, and other indoor spaces. Houses influence our quality of life, health, and productivity. Yet not many people realize that the environmental footprint of buildings plays a major role in our society. In addition to electricity, heat, and water for operation, very energy-intensive building materials such as steel and concrete are used in their production. In fact, the building sector is responsible for almost 40% of greenhouse gas emissions and 20-30% of water and material consumption worldwide.

EU Green Deal

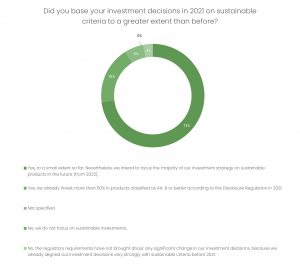

The EU has recognized the importance of private capital for a resource-efficient, competitive and climate-neutral economy. In a Sustainable Finance Initiative, which was enacted as part of the European Green Deal, the EU has set appropriate incentives and framework conditions to reduce the environmental footprint of buildings. Through sustainable capital investments in ESG funds, investors are encouraged to accelerate the environmentally friendly refurbishment of buildings and promote the construction of sustainable, socially mixed neighbourhoods with renewable energy supplies. That these incentives are indeed working is already becoming evident within the real estate industry. In 2021, more investment decisions took sustainable criteria into account than in the previous year.

Investments and social impact

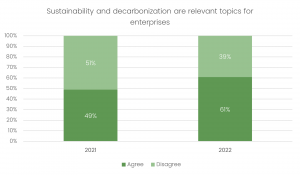

Not only does society benefit from such sustainable investments, but also many funds and their investors. The three ESG areas – environment, society, and governance – add an additional dimension to traditional risk management. ESG departments monitor trends and regulations and analyze the consequences for funds. Here, the greatest impact is currently to be expected from the climate crisis. Ambitious climate targets and political measures such as the CO2 price, subsidy conditions, refurbishment requirements, and stricter energy standards are changing the existing structures on the real estate market. For companies, sustainability and decarbonization are thus becoming increasingly important every year. Demand is shifting more and more towards energy-efficient and thus operating-cost-saving buildings. As a result, property buyers are increasingly encouraged to include sustainable investments in their purchase offers due to stricter energy requirements. Buildings whose materials are recyclable will experience a high value as a material bank even decades from now. Funds that recognize such shifts early on can integrate changes into their asset management and increase the value of their land or property investments over the long term.

DLE commits to sustainable investment principles

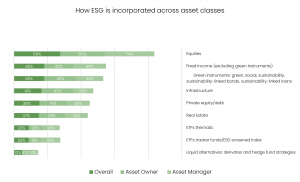

In this sense, the DLE Group is committed to sustainable investments by signing the Principles for Responsible Investment (PRI) and has set these out in its own Responsible Investment Policy (link). In order to capture purchases, risks, and opportunities in the areas of environment and society, DLE uses additional ESG scorecards. The selection and weighting of such scorecard criteria are based not only on established certification standards for sustainable buildings (e.g. DGNB, LEED, BNB) but also on industry-standard indicators for sustainability reporting at the company and fund level (e.g. GRI, GRESB, PRI, INREV). With our sustainable investment principles, we are pioneers in an industry that has so far remained in the average range with regard to the incorporation of ESG components.

ESG scorecards

In the sustainability funds initiated by DLE, investment properties must achieve a minimum score in the scorecard to be considered for investment. Some funds, including the DLE Senior Living Fund and the DLE Logistics Fund, aim for sustainable improvement after purchase. Through measures such as green leases and the installation of solar panels on roofs for independent power supply, the environmental footprint of the buildings is minimized in the long term. At the same time, this creates added value for society. The two funds, DLE Senior Living and Logistics, like the DLE Sustainable Mezzanine Fund, are classified as ESG funds under the EU’s Sustainable Finance Disclosure Regulation (SFDR) in accordance with Article 8 – not least because their investment strategy includes binding ESG criteria.

Social standards

Another important component of sustainable funds is the respect of human and labour rights, the avoidance of corruption or distortion of competition, and other unfair economic practices. In the case of DLE-ESG funds, there is regular monitoring that checks the investments of the ESG funds in line with internationally agreed social standards (OECD Guidelines for Multinational Enterprises1, UN Guiding Principles for Business and Human Rights2). If discrepancies are found, the parties involved are informed in order to mitigate the impact and agree on preventive measures.

ESG fund management

In addition to investment strategies, fund management is also crucial for the quality of ESG funds. At DLE, a dedicated ESG department takes care of establishing processes that ensure optimal implementation of the investment strategies. We require our fund managers and advisors to have expertise in environmental and social issues. For us, active asset management goes hand in hand with appropriate measures such as green leases, energy audits, the installation of smart meters, or the switch to green electricity from the roof.

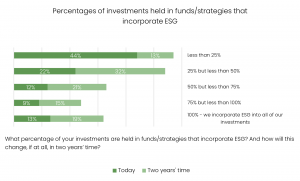

Evidence that there is still room for improvement in the practical implementation of the EU’s sustainability initiatives can be seen in the percentage of investments in the sector that include ESG components. Almost half of all companies active in the real estate sector include ESG components in less than 25% of their investments held in funds and strategies.

Tax compliant investments in practice

The sustainable implementation of investment strategies also requires internal or, ideally, external controls. This also includes transparent and regular reporting that is tailored to the investors’ need for information. The latter will be significantly shaped by EU regulation, as investors will in future have to publish the proportion of investments that conform to the EU taxonomy.

EU tax-compliant investments are assets that demonstrably meet the sustainability criteria defined by the EU and contribute to one of six environmental goals. For the real estate sector, climate protection and adaptation to climate change are particularly relevant. The EU Disclosure Regulation (SFDR) also requires sustainable funds to increasingly account for their investments. Preliminary key figures in the real estate sector, for example, ask about investments in energy-inefficient buildings or investments dedicated to fossil fuels. Furthermore, data on energy consumption and greenhouse gas emissions of a fund are needed to determine its “Principal Adverse Impacts”.

For many assets, however, such consumption data is not yet available across Germany. The difficulty here lies in the time-consuming retrieval of the data. Funds can only obtain the necessary information from tenants or through extensive inquiries with local utilities. In addition, the data collected is supplied in a wide variety of formats, so that it must be subsequently standardized. This effort however is offset by a high benefit. Based on the data, targeted measures to reduce consumption can be taken and effectively demonstrated.

Sustainability initiatives – driver with wide scope for interpretation

DLE welcomes the European sustainability initiatives for the financial market, especially the Disclosure and Taxonomy Regulations, as an urgently needed diver for the transformation to a sustainable economy. However, like many market participants, DLE thus faces the major challenge of implementing the new and complex technical regulatory standards. At the same time, the new regulatory texts offer a wide scope for interpretation and are only gradually being fleshed out by technical standards. It needs to be emphasized here, for example, that the European Commission has already postponed the adoption of the technical standards of the Disclosure Regulation twice – due to the scope and technical details.

In the real asset sector, there is additionally the difficulty that guidelines and standards are primarily designed with equity investments in mind and cannot always be intuitively applied to real assets. For example, the EU Disclosure Regulation defines a sustainable investment based on three elements: (1) measurable contribution to a specific environmental or social objective, (2) no detriment to other objectives, and (3) good corporate governance. This might lead one to assume that funds that do not invest directly in companies omit the third element and that investments are considered sustainable if they fulfill the first two conditions. However, this is not the case.

Alternatively, consideration should therefore be given to extending the scope of application for building investments – similar to the supply chain in other economic sectors – to include main contractors. For instance, we at DLE record and evaluate ESG management structures of large building operators and project financiers in sustainability funds.

Climate protection

Finally, there are still implementation challenges regarding the EU Taxonomy Regulation. Accordingly, climate protection funds may only acquire buildings that have a Class A energy certificate or are locally among the top 15% with regard to their energy efficiency. German energy certificates, however, only issue the energy class for residential buildings and are not applicable to office or logistics properties. Furthermore, there is yet no definitional consensus, on what counts as top 15% energy efficient buildings. It is unclear whether this percentage figure should apply at the state, district or national level. Depending on the area, the values can vary significantly and leave room opportunistic interpretations.