ASSET MANAGEMENT

DLE: The land developers

The Berlin-based DLE Group is one of Europe’s leading providers of land development and Germany’s premier asset management company. This overview explains the activities of DLE Group AG, as well as its subsidiaries in the Senior Living/ Assisted Living sector and in the Value-Add Logistics Fund sector.

Sustainable Investing

The DLE Group wants to have a positive impact on society which is why sustainable and responsible investments are a high priority for Europe’s leading asset management platform. This motivated DLE Living to develop the ESG-Scorecard together with a leading ESG consultant to enable ESG fund investments.

Digital Investment Platform

Our digital investment platform gives our investors access to our products. The DLE App allows them to track their existing investments and shows them information and news coverage about their products. This digital platform turns our slogan “RETHINK REAL ESTATE“ into reality.

Taking over Responsibility

To develop projects in an integrative manner and to reduce the existing housing shortage in major German cities most effectively, DLE cooperates with public agencies, municipal utilities, and project developers. The goal and aspiration of DLE as a land developer is to realize the projects on the developed sites as quickly as possible.

Asset Management in Berlin

This overview of the relevant terms and processes of the asset management industry also provides an insight into the relevant ESG criteria, such as the Sustainable Mezzanine Fund. The identification of sustainability risks and opportunities as well as the integration of sustainability aspects into DLE’s services are clearly explained. In addition to the ESG criteria and the ESG approach of the DLE platform, the commitment to integrate ESG aspects in initiated funds of DLE within the framework of the Principles for Responsible Investments will also be addressed.

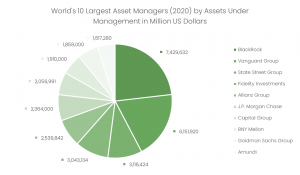

In addition to the German asset management market, the largest asset management providers in Europe and worldwide will also be listed.

Asset Management Germany – The next generation of Asset Management for Berlin real estate.

As an asset manager based in Berlin, we manage mandates from private individuals as well as institutional investors. The asset management platform enables us to further develop our offerings. In addition, DLE creates profitable and sustainable growth that combines attractive returns with socially added value.

Sustainable Asset Management in Berlin

The DLE Group integrates environmental, social, and governance criteria into its sustainable asset management. Our strategy combines Sustainable Investing with Responsible Investing. For this reason, we are integrating ESG aspects into all funds initiated by DLE and are developing DLE’s ESG Fund Investment. We have already implemented our ESG approach in our Sustainable Mezzanine Fund.

Benefit for Investors

We use our expertise along the entire value chain in the real estate sector to create synergies in asset management. We offer our investors a broad range of opportunities in the form of various closed-end real estate funds.

Broad portfolio

Our investment focus is on land banking and development. In recent years, we have been able to further develop our business and use our expertise to serve current and future needs. We have expanded into the Senior Living and Assisted Living asset classes. With our Value-add Logistics Fund, we cover another exciting sector. Our portfolio also includes Capital Financing which offers solution-oriented financing approaches for developers and investors.

What is asset management?

Asset management refers to the financial service of managing assets using financial instruments to increase the invested assets. Asset managers look after their customers’ investment assets and make investment decisions based on the customers’ risk tolerance and asset situation (source: AssetMetrix). The business area focuses on managing significant private and institutional financial assets of different risk classes. Risk classes in asset management include equities, bonds, real estate, and liquidity (source: Wikipedia). The goal of asset managers is to optimize the assets of their customers according to certain criteria.

The 10 Worlds’ largest asset manager: